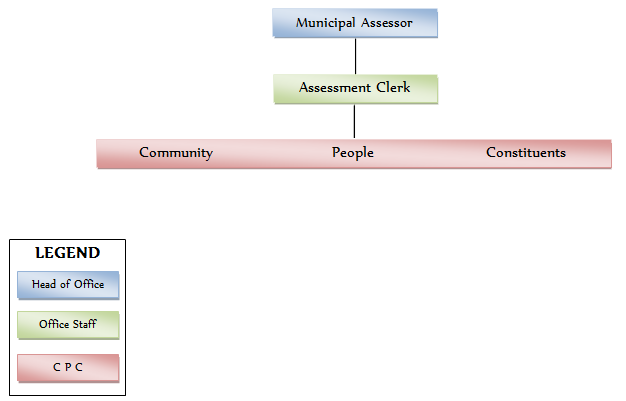

Municipal Assessor’s Office

ORGANIZATIONAL STRUCTURE

duties and responsiblities

SEC. 472 . Qualifications, Powers and Duties. – (a) No person shall be appointed assessor unless he is a citizen of the Philippines, a resident of the local government unit concerned, of good moral character, a holder of a college degree preferably in civil or mechanical engineering, commerce, or any other related course from a recognized college or university, and a first grade civil service eligible or its equivalent. He must have acquired experience in real property assessment work or in any related field for at least five (5) years in the case of the city or provincial assessor, and three (3) years in the case of the municipal assessor. The appointment of an assessor shall be mandatory for provincial, city and municipal governments.

(b) The assessor shall take charge of the assessor’s office, perform the duties provided for under Book II of this Code, and shall:

(1) Ensure that all laws and policies governing the appraisal and assessment of real properties for taxation purposes are properly executed;

(2) Initiate, review, and recommend changes in policies and objectives, plans and programs, techniques, procedures and practices in the valuation and assessment of real properties for taxation purposes;

(3) Establish a systematic method of real property assessment;

(4) Install and maintain a real property identification and accounting system,

(5) Prepare, install and maintain a system of tax mapping, showing graphically all property subject to assessment and gather all data concerning the same;

(6) Conduct frequent physical surveys to verify and determine whether all real properties within the province are properly listed in the assessment rolls;

(7) Exercise the functions of appraisal and assessment primarily for taxation purposes of all real properties in the local government unit concerned;

(8) Prepare a schedule of the fair market value for the different classes of real properties, in accordance with Title Two under Book II of this Code;

(9) Issue, upon request of any interested party, certified copies of assessment records of real property and all other records relative to its assessment, upon payment of a service charge or fee to the treasurer;

(10) Submit every semester a report of all assessments, as well as cancellations and modifications of assessments to the local chief executive and the sanggunian concerned;

(11) In the case of the assessor of a component city or municipality attend, personally or through an authorized representative, all sessions of the local board of assessment appeals whenever his assessment is the subject of the appeal, and present or submit any information or record in his possession as may be required by the board; and,

(12) In the case of the provincial assessor, exercise technical supervision and visitorial functions over all component city and municipal assessors, coordinate with component city or municipal assessors in the conduct of tax mapping operations and all other assessment activities, and provide all forms of assistance therefor: Provided, however, That, upon full provision by the component city or municipality concerned to its assessor’s office of the minimum personnel , equipment, and funding requirements as may be prescribed by the Secretary of Finance, such functions shall be delegated to the said city or municipal assessor; and

(c) Exercise such other powers and perform such other duties and functions as may be prescribed by law or ordinance.

SEC. 473. Assistant Assessor. – (a) No person shall be appointed assistant assessor unless he is a citizen of the Philippines, a resident of the local government unit concerned, of good moral character, a holder of a college degree preferably in civil or mechanical engineering, commerce, or any related course from a recognized college or university, and a first grade civil service eligible or its equivalent. He must have acquired experience in assessment or in any related field for at least three (3) years in the case of the city or provincial assistant assessor, and one (1) year in the case of the city or provincial assistant assessor. The appointment of an assistant assessor shall be optional for provincial, city and municipal governments.

(b) The assistant assessor shall assist the assessor and perform such other duties as the latter may assign to him. He shall have the authority to administer oaths on all declarations of real property for purposes of assessment.

Source: The Local Code of the Philippines